Understanding Financial Wellness in the Workplace for Your Team

Financail Wellness - Corporate Wellness

Financial wellness isn’t just about numbers or having a large savings account; it’s about developing a healthy relationship with money and creating a sense of security and peace of mind.

Many people struggle with their finances, living paycheck to paycheck, unsure how to save or budget effectively. This blog post is designed to guide you on the path to financial wellness, offering practical steps and advice that you can implement right away.

Financail Wellness - Corporate Wellness

What is Financial Wellness?

Financial wellness refers to a state where your financial situation allows you to live comfortably, manage unexpected expenses, and plan for the future without undue stress.

For many, it feels like an elusive goal. It's not uncommon for individuals to feel overwhelmed, especially if they don’t fully understand budgeting or have never been taught about managing money effectively. But the truth is, anyone can achieve financial wellness with the right tools and a shift in mindset.

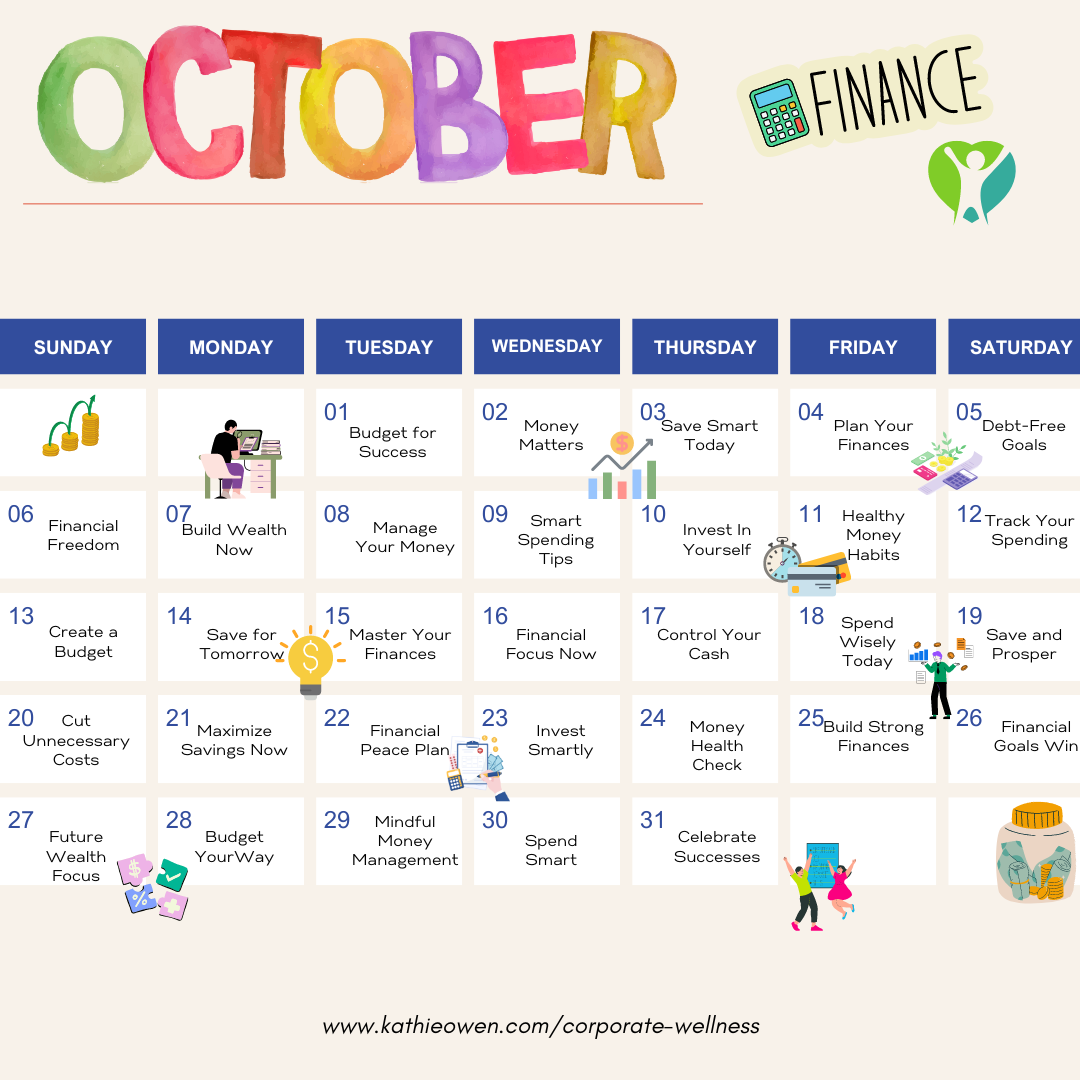

Download Your Calendar and share with your team, no matter what month we may be in!

The Reality of Living Paycheck to Paycheck

For those living paycheck to paycheck, managing finances can feel like a constant juggling act. You might be asking yourself: “How can I possibly save when there’s nothing left at the end of the month?”

This is a very real struggle for many, and the key to breaking this cycle starts with understanding where your money is going and finding small, manageable ways to regain control.

Financail Wellness - Corporate Wellness

Step 1: Know Where Your Money Goes

The first step toward financial wellness is gaining awareness of your spending. You might not realize how much small, seemingly insignificant expenses add up over time.

Begin by tracking every dollar you spend for at least one month. Write down or use an app to record all of your purchases, bills, and payments. This will give you a clear picture of your financial habits.

Once you have an overview, categorize your spending into essentials (like rent, groceries, and utilities) and non-essentials (like eating out or subscriptions).

This process can help identify areas where you might be overspending and give you insight into where you can make adjustments.

Financail Wellness - Corporate Wellness

Step 2: Create a Simple Budget

Budgeting is one of the most powerful tools in achieving financial wellness, but it’s often misunderstood. A budget is not about restricting yourself or feeling deprived; it’s about telling your money where to go so you’re in control of it. The key to budgeting is simplicity.

A good starting point is the 50/30/20 rule:

50% of your income goes toward needs (housing, utilities, groceries).

30% is for wants (dining out, entertainment, hobbies).

20% is for savings and debt repayment.

This method gives you flexibility while ensuring that you are making room for savings and paying down debt. If your situation is particularly tight, you might need to adjust the percentages temporarily, perhaps by cutting down on wants and allocating more to savings or debt.

Financail Wellness - Corporate Wellness

Step 3: Build an Emergency Fund

An emergency fund is a financial safety net for life’s unexpected events—like car repairs, medical bills, or job loss. Without it, even a small surprise expense can send your budget spiraling out of control.

Building an emergency fund might seem impossible if you're living paycheck to paycheck, but even small contributions matter. Start by setting aside $5, $10, or $20 from each paycheck. Over time, these small amounts will grow, and having even a modest emergency fund can make a big difference.

Aim to have at least $500 saved as an initial goal, and eventually, work toward saving three to six months of living expenses. This will provide you with a sense of security and the ability to handle life's surprises without turning to credit cards or loans.

Financail Wellness - Corporate Wellness

Step 4: Understand Debt and How to Manage It

Debt is one of the biggest barriers to financial wellness. Credit card debt, student loans, and personal loans can feel overwhelming, but with a strategic plan, they can be managed and reduced over time.

Start by making a list of all your debts, including the interest rates and minimum monthly payments. Once you have this list, you can choose between two popular methods for paying off debt:

The Snowball Method: Focus on paying off your smallest debt first while making minimum payments on the others. Once the smallest debt is paid off, move to the next smallest. This method provides psychological wins as you see debts eliminated.

The Avalanche Method: Focus on paying off the debt with the highest interest rate first, as this will save you more money in the long run. Once the highest-interest debt is paid off, move to the next highest.

Whichever method you choose, be consistent. Even paying a little more than the minimum on your highest priority debt can lead to significant progress over time.

Financail Wellness - Corporate Wellness

Step 5: Cultivate a Money Mindset

A significant part of financial wellness involves cultivating a healthy money mindset. Many people grew up with limiting beliefs about money—that it’s scarce, that saving is impossible, or that they’ll always be in debt. These thoughts can create self-sabotaging behaviors that prevent financial growth.

To improve your money mindset:

Practice gratitude for what you have, rather than focusing on what you lack.

Avoid comparison traps—your financial journey is unique to you.

Celebrate small financial victories, whether it’s saving $10 or paying off a credit card.

Learn about finances regularly. Knowledge is power, and the more you know, the more confident you’ll feel in managing your money.

Financail Wellness - Corporate Wellness

Step 6: Plan for the Future

Financial wellness is not just about handling the present; it’s also about planning for the future. Once you have a handle on your budget, have started saving, and are managing your debt, it’s important to think long-term.

Retirement: If your employer offers a retirement plan, such as a 401(k), make sure you’re contributing to it, especially if there’s a company match. The earlier you start, the more your money will grow due to compound interest.

Investments: Consider learning more about investments, even if it feels intimidating. There are simple ways to start investing with small amounts of money, and over time, these investments can significantly contribute to your financial future.

Insurance: Protecting your assets with insurance (health, home, car, life) is a critical part of financial wellness. Ensure you have the coverage you need to avoid major setbacks due to unforeseen events.

Step 7: Don’t Be Afraid to Ask for Help

Achieving financial wellness is a journey, and you don’t have to do it alone. If you’re struggling, consider speaking with a financial advisor or a financial coach who can offer guidance and help you create a plan tailored to your situation.

Many employers, including corporate wellness programs, now offer financial wellness resources, such as workshops, tools, and access to advisors. Take advantage of these opportunities and begin building your financial knowledge.

Financail Wellness - Corporate Wellness

Final Thoughts

Financial wellness is not about perfection; it’s about progress. By taking small, manageable steps, you can begin to shift from feeling overwhelmed by your finances to feeling in control and confident. Whether it’s tracking your spending, creating a simple budget, or building an emergency fund, these steps will help you achieve greater peace of mind.

Remember, you are not alone on this journey, and with consistency and the right mindset, financial wellness is within your reach. Start today, one step at a time.

About the Author:

Kathie Owen is a seasoned Corporate Wellness Professional with over a decade of experience driving wellness initiatives.

Kathie Owen, Corporate Wellness Professional since 2012 (Our Story)

With a rich background as a certified fitness trainer and life coach since 2002, Kathie combines her practical expertise in health and wellness with a deep understanding of psychological principles, thanks to her degree in Psychology.

Her holistic approach to corporate wellness not only fosters a culture of health and engagement among employees but also supports organizations in achieving their most ambitious wellness goals.

Kathie's Coaching and Consulting reflects her passion for empowering corporate executives to create thriving workplace environments through strategic wellness programs and employee engagement.

From corporate burnout to Chief Encouragement Officer: I transformed anxiety into leadership using sports psychology, intuition, and Neville Goddard's visualization. Now I help executives perform under pressure and lead with encouragement through the Encouragement Collective.

#ChiefEncouragementOfficer #BurnoutRecovery #SportsPsychology #LeadershipDevelopment #ExecutiveWellness #MindsetCoach